The Best Strategy To Use For Guided Wealth Management

The Best Strategy To Use For Guided Wealth Management

Blog Article

Some Known Incorrect Statements About Guided Wealth Management

Table of ContentsMore About Guided Wealth ManagementSome Ideas on Guided Wealth Management You Need To Know4 Easy Facts About Guided Wealth Management DescribedLittle Known Facts About Guided Wealth Management.The Basic Principles Of Guided Wealth Management Guided Wealth Management for Beginners

Picking an efficient financial advisor is utmost essential. Expert functions can differ depending on numerous factors, including the kind of financial advisor and the customer's needs.A restricted advisor should declare the nature of the limitation. Giving appropriate plans by evaluating the background, monetary information, and capabilities of the customer.

Offering critical plan to coordinate individual and organization funds. Directing customers to execute the financial strategies. Evaluating the implemented plans' performance and updating the carried out strategies on a regular basis regularly in different phases of clients' development. Normal monitoring of the monetary profile. Maintain monitoring of the customer's tasks and verify they are complying with the right course. https://medium.com/@bradcumner4020/about.

If any kind of issues are come across by the management consultants, they figure out the source and solve them. Develop an economic risk analysis and assess the prospective result of the risk. After the conclusion of the threat evaluation version, the advisor will certainly analyze the outcomes and offer an ideal service that to be carried out.

How Guided Wealth Management can Save You Time, Stress, and Money.

They will certainly aid in the accomplishment of the economic and workers objectives. They take the obligation for the provided decision. As an outcome, clients require not be concerned regarding the decision.

This led to a rise in the internet returns, price savings, and also led the course to earnings. Several procedures can be compared to recognize a qualified and qualified consultant. Usually, experts require to meet conventional scholastic qualifications, experiences and qualification suggested by the federal government. The standard educational credentials of the consultant is a bachelor's level.

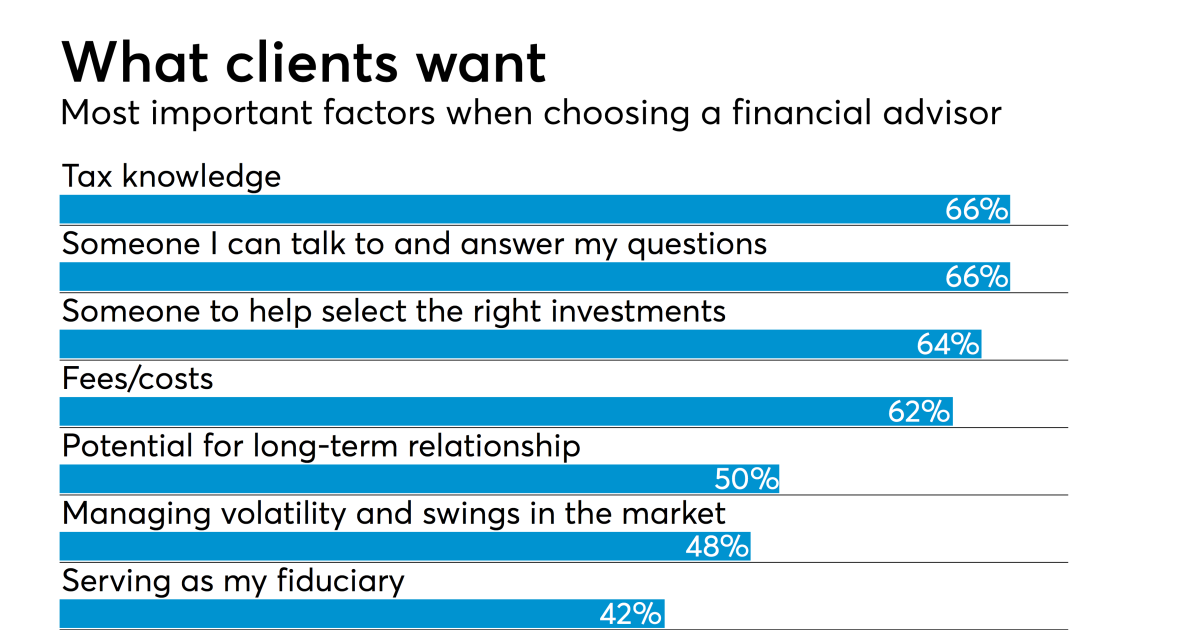

While looking for a consultant, please take into consideration credentials, experience, abilities, fiduciary, and settlements. Look for clarity up until you get a clear idea and complete complete satisfaction. Constantly make certain that the advice you obtain from a consultant is constantly in your best passion. Inevitably, economic experts make best use of the success of a business and also make it grow and thrive.

Top Guidelines Of Guided Wealth Management

Whether you need a person to help you with your tax obligations or stocks, or retired life and estate planning, or every one of the above, you'll find your answer here. Maintain checking out to discover what the difference is between a financial consultant vs organizer. Generally, any kind of specialist that can help you manage your cash in some fashion can be taken into consideration an economic advisor.

If your objective is to develop a program to meet long-term financial objectives, then you probably desire to enlist the solutions of a qualified economic planner. You can look for an organizer that has a speciality in taxes, investments, and retirement or estate planning.

A financial consultant is just a wide term to define a professional that can aid you manage your cash. They might broker the sale and purchase of your stocks, handle investments, and help you create a comprehensive tax obligation or estate plan. It is important to note that an economic expert must hold an AFS license in order to offer the public.

Indicators on Guided Wealth Management You Should Know

If your monetary expert checklists their solutions as fee-only, you ought to anticipate a list of solutions that they give with a failure of those charges. These specialists don't provide any type of sales-pitch and typically, the solutions are cut and dry and to the factor. Fee-based consultants charge an upfront cost and after that earn compensation on the monetary products you buy from them.

Do a little research initially to make sure the monetary advisor you hire will certainly have the ability to look after you in the long-term. The finest area to start is to ask for referrals from family members, close friends, associates, and neighbours that remain in a comparable economic scenario as you. Do they have a trusted monetary consultant and just how do they like them? Asking for referrals is an excellent way to learn more about an economic advisor prior to you even satisfy them so you can have a far better idea of how to manage them up front.

How Guided Wealth Management can Save You Time, Stress, and Money.

You ought to constantly factor prices right into your financial planning scenario. Carefully evaluate the fee frameworks and ask inquiries where you have complication or problem. Make your potential consultant address these concerns to your contentment prior to moving ahead. You may be searching for a specialized consultant such as somebody that concentrates on divorce or insurance planning.

An economic expert will assist you with setting attainable and practical goals for your future. This might be either beginning a business, a household, preparing for retirement every one of which are necessary chapters in life that require cautious factor official site to consider. A financial consultant will take their time to review your circumstance, short and lengthy term objectives and make referrals that are best for you and/or your family members.

A research study from Dalbar (2019 ) has highlighted that over twenty years, while the ordinary investment return has actually been around 9%, the average financier was only getting 5%. And the distinction, that 400 basis points each year over 20 years, was driven by the timing of the financial investment choices. Handle your portfolio Protect your assets estate planning Retired life planning Handle your very Tax obligation financial investment and administration You will be called for to take a threat tolerance set of questions to provide your consultant a more clear photo to identify your investment property allocation and choice.

Your expert will certainly check out whether you are a high, tool or reduced danger taker and established an asset allotment that fits your risk tolerance and ability based upon the info you have actually given. A risky (high return) person may spend in shares and property whereas a low-risk (low return) person might want to spend in cash and term deposits.

Unknown Facts About Guided Wealth Management

When you engage a financial expert, you don't have to handle your profile. It is important to have appropriate insurance plans which can provide tranquility of mind for you and your household.

Having an economic advisor can be incredibly valuable for lots of individuals, but it is necessary to consider the advantages and disadvantages before making a decision. In this short article, we will certainly discover the benefits and downsides of dealing with an economic advisor to assist you decide if it's the ideal move for you.

Report this page